Top Suggestions For Securing A Home Mortgage

Content written by-Kuhn McQueenAre you planning to buy a new home? Or is your current mortgage too high thanks to the slumping economy? Do you need to refinance or take on a second mortgage to complete work on your home? No matter what reason you have for seeking a mortgage, this article has what you need to know.

Getting the right mortgage for your needs is not just a matter of comparing mortgage interest rates. When looking at offers from different lending institutions you must also consider fees, points and closing costs. Compare all of these factors from at least three different lenders before you decide which mortgage is best for you.

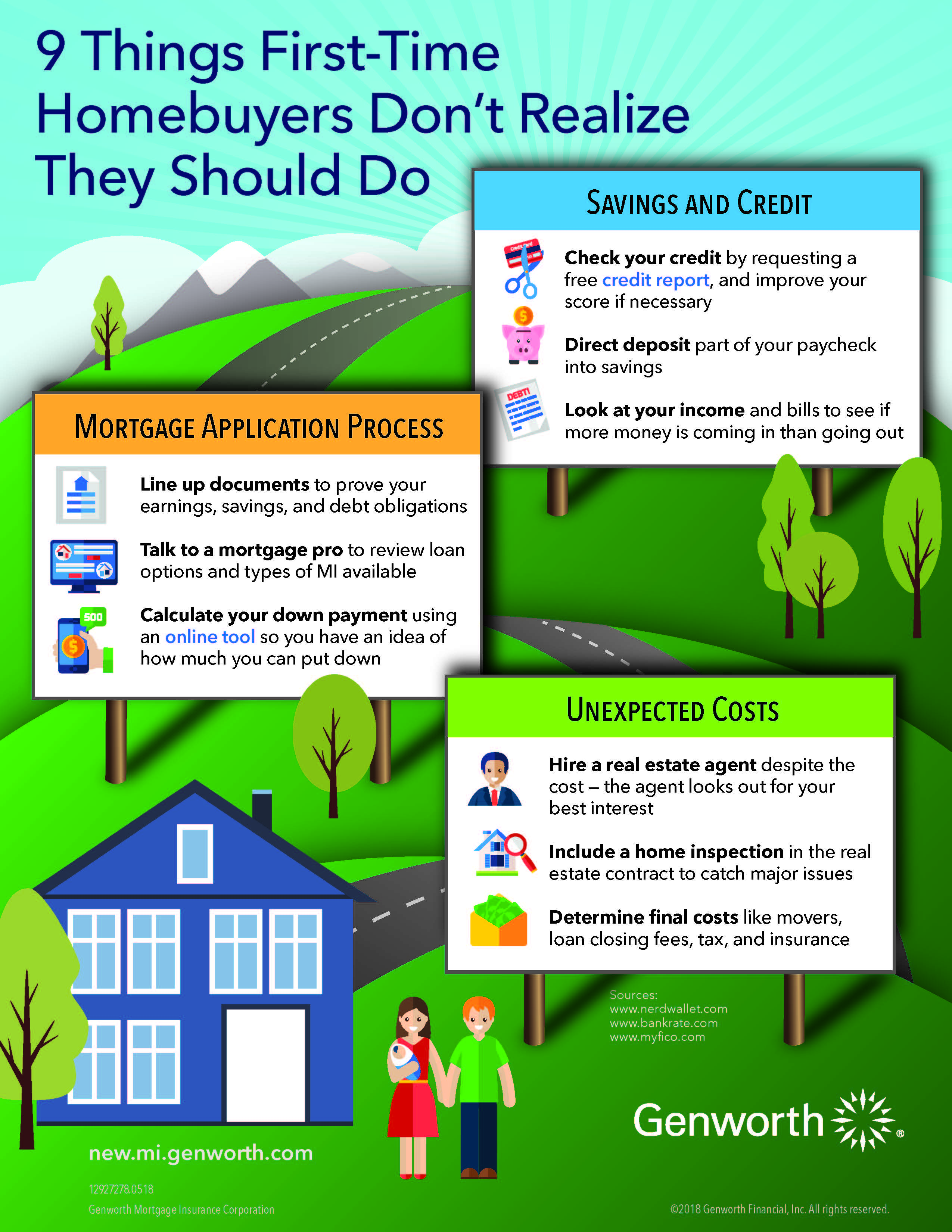

Start saving all of your paperwork that may be required by the lender. These documents include pay stubs, bank statements, W-2 forms and your income tax returns. Keep these documents together and ready to send at all times. If you don't have your paperwork in order, your mortgage may be delayed.

A down payment is usually required when you are applying for a home mortgage. Most firms ask for a down payment, but you might find some that don't require it. You should find out how much you need to put down early on, so there are no surprises later.

When financing a house, giving a large down payment will result in a lower mortgage rate. This is due to the fact that a big down payment will reduce your loan to value ratio. When the loan to value ratio gets lower, the interest rates become more favorable for the home buyer.

Make a budget to define exactly how much you are willing to pay each month towards your mortgage. This means setting a limit for monthly payments, based on what you can afford and not just what type of house you want. No matter how wonderful your new home is, trouble will follow if the payments are too high.

Make sure you've got all of your paperwork in order before visiting your mortgage lender's office for your appointment. While logic would indicate that all you really need is proof of identification and income, they actually want to see everything pertaining to your finances going back for some time. Each lender is different, so ask in advance and be well prepared.

Learn about the three main types of home mortgage options. The three choices are a balloon mortgage, a fixed-rate mortgage, and an adjustable-rate mortgage (ARM). Each of these types of mortgages has different terms and you want to know this information before you make a decision about what is right for you.

Keep in mind that not all mortgage lending companies have the same rules for approving mortgages and don't be discouraged if you are turned down by the first one you try. Ask for https://www.fool.com/the-ascent/mortgages/articles/3-steps-to-qualify-for-a-mortgage-by-the-end-of-the-year/ of why you were denied the mortgage and fix the problem if you can. It may also be that you just need to find a different mortgage company.

Learn about the three main types of home mortgage options. https://www.gobankingrates.com/banking/banks/chase-vs-wells-fargo/ are a balloon mortgage, a fixed-rate mortgage, and an adjustable-rate mortgage (ARM). Each of these types of mortgages has different terms and you want to know this information before you make a decision about what is right for you.

Do not allow yourself to fall for whatever the banks tell you about getting a home mortgage. You have to remember that they are in the business of making money, and many of them are willing to use techniques to suck as much of that money out of you that they can.

Think about your job security before you think about buying a home. If you sign a mortgage contract you are held to those terms, regardless of the changes that may occur when it comes to your job. For example, if you are laid off, you mortgage will not decrease accordingly, so be sure that you are secure where you are first.

Know the risk involved with mortgage brokers. Many mortgage brokers are up-front with their fees and costs. Some other brokers are not so transparent. They will add costs onto your loan to compensate themselves for their involvement. This can quickly add up to an expense you did not see coming.

There are times when the seller of a home will be able to give you a land contract so you can purchase the home. The seller needs to own the home outright, or owe very little on it for this to work. A land contract may need to be paid within a few years.

Don't take out a mortgage for the maximum amount the bank will lend you. This was a strategy that backfired on thousands of people a few short years ago. They assumed housing values would inevitably rise and that payment would seem small in comparison. Make out a budget, and leave yourself plenty of breathing room for unexpected expenses.

Opt out of credit offers before applying for a home mortgage. Many times creditors will pull a credit file without your knowledge. This can result in an immediate decline for a home mortgage. To help prevent this from happening to you, opt out of all credit offers at least six months before applying for a loan.

If your mortgage lender will give you a letter of approval, it may open some doors with sellers. This type of letter speaks well of your financial standing. However, make sure that the approval letter is for the amount of your offer. If it shows a higher amount, then the seller will see this and realize you could pay more.

Be honest when it comes to reporting your financials to a potential lender. Chances are the truth will come out during their vetting process anyway, so it's not worth wasting the time. And if your mortgage does go through anyway, you'll be stuck with a home you really can't afford. It's a lose/lose either way.

During the process of obtaining a mortgage loan, submit any requested documents to your mortgage broker or lender as soon as possible. Taking your time to respond to your lender can delay the date of the closing. Delaying the closing date can put you at risk of losing the rate you have locked-in.

You will find a lot of information about securing a mortgage. With this information, you should be more informed. When you want to get a home loan, use the tips shared here.